Fascination About Offshore Company Formation

Table of ContentsExcitement About Offshore Company FormationOffshore Company Formation Can Be Fun For AnyoneOffshore Company Formation for DummiesThe Definitive Guide for Offshore Company Formation

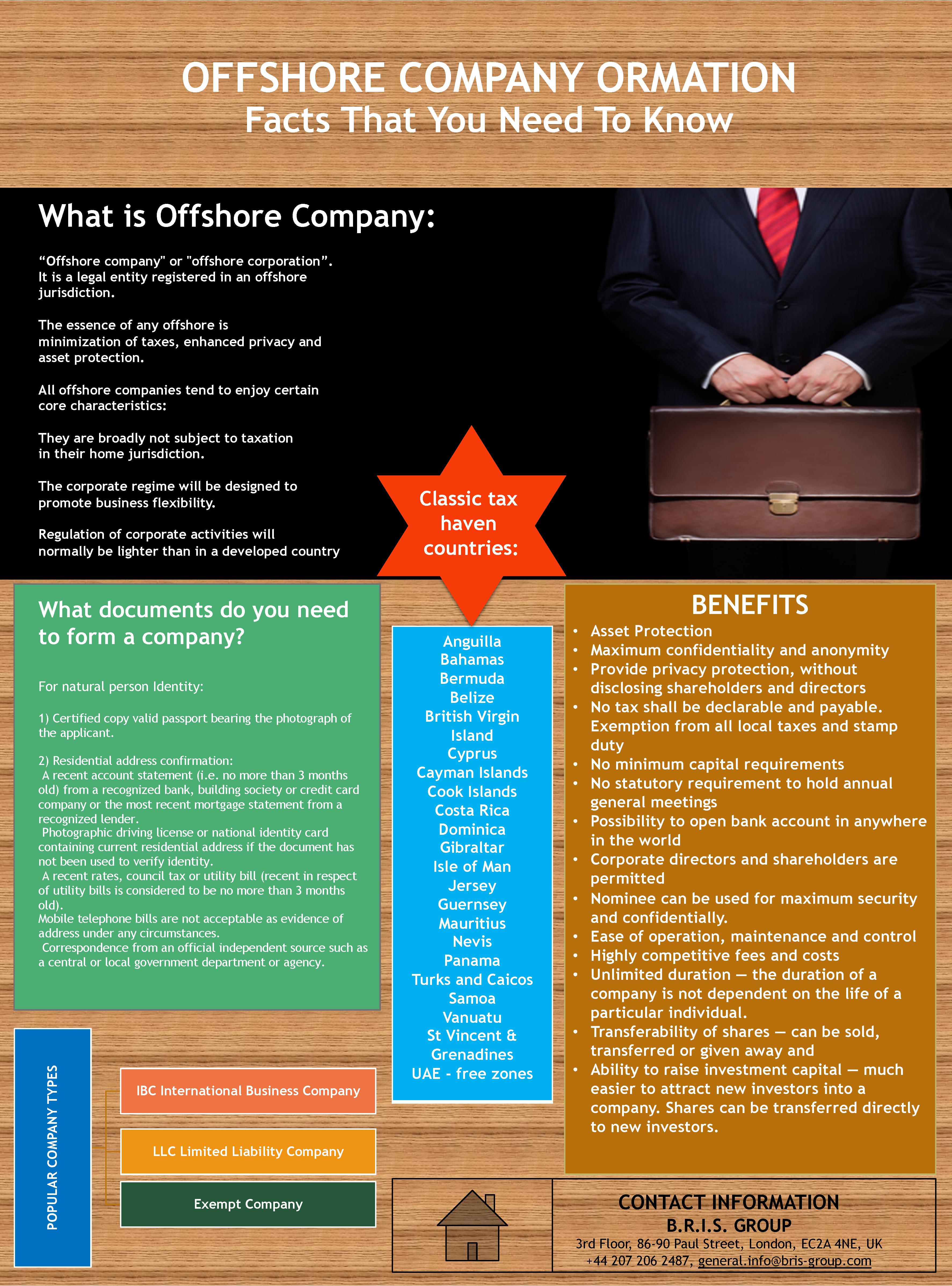

Given all these advantages, an offshore business formation in Dubai is the most suitable kind of venture if you are looking for to understand goals and/or tasks such as any of the following: Provide expert solutions, consultancy, and/or serve as a firm Resource foreign skill/ expatriate staff Feature as a Property Owning & Investment Firm International trade Captive insurance policy Tax obligation exemption However, overseas business in UAE are not allowed to take part in the adhering to organization tasks: Money Insurance as well as Re-insurance Aviation Media Branch set-up Any company activity with onshore firms based in UAE Company Advantages Of A Dubai Offshore Business Formation Outright privacy and privacy; no disclosure of shareholders as well as accounts required 100 percent complete ownership by an international national; no local sponsor or partner needed 100 per cent exception from corporate tax for half a century; this choice is renewable 100 percent exemption from personal earnings tax obligation 100 percent exception from import and re-export obligations Defense and also management of properties Business procedures can be performed on an international degree No limitations on international ability or employees No limitations on currencies and no exchange policies Office is not needed Capacity to open and keep financial institution accounts in the UAE as well as overseas Ability to invoice local and global clients from UAE Incorporation can be completed in much less than a week Capitalists are not required to show up prior to authority to help with consolidation Vertex Global Consultants gives been experts overseas firm setup options to assist foreign entrepreneurs, financiers, and companies develop a local visibility in the UAE.What are the offered territories for an overseas firm in Dubai as well as the UAE? In Dubai, currently, there is only one overseas jurisdiction readily available JAFZA offshore.

Additionally, physical existence within the nation can also help us get all the paperwork done without any type of problems. What is the timeframe required to start an overseas firm in the UAE? In a suitable situation, setting up an offshore firm can take anywhere between 5 to 7 working days. It is to be noted that the enrollment for the same can only be done via a registered agent.

Unknown Facts About Offshore Company Formation

The offshore firm enrollment procedure have to be undertaken in total supervision of a business like us. The demand of going for overseas company enrollment process is required prior to setting up a company. As it is called for to fulfill all the conditions then one must describe a proper association.

An is specified as a company that is included in a jurisdiction that is aside from where the advantageous owner stays. Simply put, an overseas firm is just a business that is included in a country overseas, in a foreign jurisdiction. An offshore company interpretation, nevertheless, is not that basic and also will have differing interpretations relying on the conditions.

Things about Offshore Company Formation

While an "onshore business" describes a residential company that exists and operates within the boundaries of a country, an overseas company in comparison is an entity that carries out all of its transactions outside the boundaries where it is incorporated. Because it is owned and also exists as a non-resident entity, it is not accountable to local taxes, as all of its financial deals are made outside the limits of the jurisdiction where it lies.

Business that are created in read here such offshore territories are non-resident due to the fact that they do not conduct any financial deals within their borders and are had by a non-resident. Forming an overseas company outside the country of one's very own home includes extra protection that is found only when a business is integrated in a separate legal system.

Because offshore companies are identified as a different legal entity it operates as a separate individual, distinct from its proprietors or directors. This splitting up of powers makes a difference between the owners and the business. Any type of actions, financial debts, or liabilities handled by the company are not passed to its directors or participants.

The Basic Principles Of Offshore Company Formation

While there is no single standard whereby to measure an offshore firm in all overseas jurisdictions, find out this here there are a number of features and distinctions distinct to particular monetary centres that are considered to be offshore centres. As we have actually said since an offshore company is a non-resident and also performs its transactions abroad it is not bound by local corporate taxes in the country that it is included.

Conventional onshore countries such as the UK and also United States, typically seen as onshore economic centers in fact have overseas or non-resident corporate plans that permit international firms to include. These corporate structures also are able to be cost-free from neighborhood tax despite the fact that ther are formed in a normal high tax onshore setting. offshore company formation.

For more details on locating the finest nation to develop your offshore firm go right here. Individuals as well as firms pick to create an overseas firm mostly for numerous reasons. While there are distinctions in between each offshore jurisdictions, they have a tendency to blog here have the adhering to similarities: Among one of the most engaging reasons to utilize an overseas entity is that when you use an overseas corporate structure it separates you from your company along with properties as well as responsibilities.